The Monday Morning Edit: What You Missed in Fashion This Weekend

The type B fashion tech founder who just secured a fat check, the Met Gala's $31M hustle, and which CEO email has me speechless

Good morning and happy Monday to my favorite people!

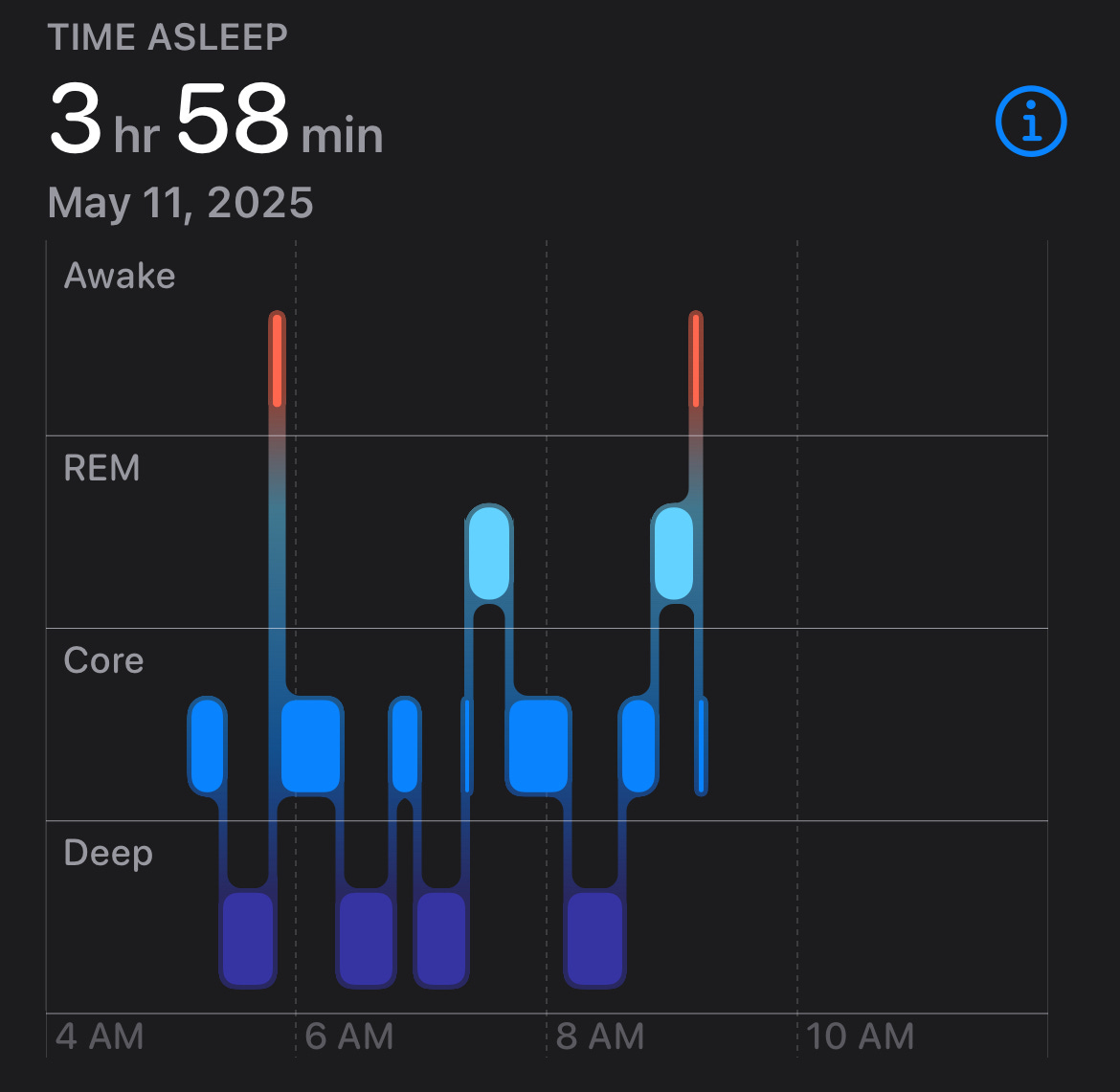

By the time you’re reading this I’ll be deep in my Monday morning plans which include a 7am hot pilates class (because I late cancelled last week and can’t do that again. and you guys know the deal- my husband reads these) and getting back in bed and sleeping for as long as possible. Enter my current sleep stats:

But I’d do anything for you guys so let’s get right into it- your Monday morning edit starts now!

Offe Market landed $1.25M from Baukunst (cc: Kate McAndrew - one of my fav LinkedIn follows) for their pre-seed round and it’s exactly the kind of funding news I can get behind - a founder who was literally couch-surfing with $0 in her bank account a year ago now building what's essentially TJ Maxx for Gen Z. The fact that only 3% of the $100B+ off-price retail market happens online is fucking wild, and founder Rachel Gannon (another fav LinkedIn follow - BTW) is capitalizing on the obvious gap. Gen-Z shopping behavior tells the whole story: 70% wait for sales, 60% prefer discounted shopping, but they want the experience to be sleek AF. What's brilliant here isn't just connecting brands with deal-hunters (though 75+ brands with 100% retention is impressive) - it's that they're creating a brand-safe liquidation solution that also addresses fashion's overproduction nightmare. Their AI pricing intelligence tool is the cherry on top, helping brands maximize recovery without brand erosion. Off-price retail growing 5x faster than full-price is the ultimate validation. This one's a winner - TYPE B FOUNDER GIRLS RISE UP!

The tariff standoff has hit holy shit territory (yay my fav topic!!) with ZERO vessels departing China for California ports in a 12-hour period - something not seen since peak COVID. When port officials are saying "that's cause for alarm" and comparing this to pandemic disruption, we should all be paying attention (I’m talking to me. I’ve been trying to disassociate SO unsuccessfully). The immediate retail impact is wild: Target-exclusive Barbie doll up 43%, Cat & Jack leggings up 33% - these aren't luxury items, they're everyday basics suddenly carrying luxury price tags. What pisses me off most is how this is decimating small businesses while big corporations secure exemptions. The 35-40% cargo decline at Long Beach is catastrophic for brands counting on summer inventory and beyond, who are literally just trying to stay alive. The White House did put out a press release saying that Geneva talks with China were going well so it’ll be interesting to see what comes out of this (hopefully as good of a deal as we got with the UK!! /s). I feel for founders like Haley Pavone (Pashion Footwear) who are transparently breaking down how these tariffs are crushing their business models while showing up in DC to do anything they can about it. The real victims here are small business owners and everyday consumers getting caught in the crossfire.

The Met Gala's $31M fundraising haul isn't just another fashion headline – it's a masterclass in turning cultural currency into actual currency. While everyone's busy dissecting Jenna Ortega's dress (how fucking witty BTW), I'm looking at the business model that just casually outperformed every other cultural fundraiser by multiples (Whitney Museum at $5.2M, NY Philharmonic: $4M, you get it). The brilliance isn't the red carpet, it's the economic engine underneath. Those $350K tables and $75K individual tickets create a scarcity marketplace where corporations will literally pay for the privilege of proximity to cultural relevance. It's not just a party; it's a financial instrument disguised as one. And the ROI is undeniable – even after dropping $6M on production costs, they're generating $4 for every $1 spent (profitable queens). The Met Gala isn't playing fashion – it's playing business, and winning.

The RealReal's Q1 numbers – 11% sales growth and positive adjusted EBITDA of $4.1M – should be cause for celebration, but investors still sent shares tumbling 10.8% after hours. Why? Wall Street clearly sees the fundamental tension in their business model: taking possession of inventory creates operational complexity and capital intensity that asset-light marketplaces avoid (Depop’s DLs on the app store are through the roof lately). CEO Rati Levesque highlighting their domestic supply chain as tariff protection misses the bigger issue – the luxury market itself is contracting rapidly (split on if this is a positive for them with lower prices OR if overall customer sentiment towards luxury is bleak, no matter the price), with LVMH cutting 1,200 jobs and admitting "all divisions are in crisis." Their current $6.50 share price (down from $28 at IPO) reflects the market's fundamental skepticism about whether luxury resale can deliver both growth and profitability simultaneously in this environment. Not even The RealReal's focus on sustainability (cited by 49% of members as their primary motivation. honestly, would’ve never guessed that) can overcome investor doubts about the structural economics of their model (and that’s after some insane financial moves this year that put them in such good standing). I’m feeling hopeful for them though, esp. with Rati at the helm.

Target's all-staff email amid 10 straight weeks of traffic decline perfectly illustrates their current problem - complete disconnect from reality. Declaring values "non-negotiable. Period." after literally negotiating them away with their DEI rollback is corporate gaslighting at it’s finest. Meanwhile, Costco maintained their commitments and enjoyed 7.5% growth – funny how that works. The disconnect between claiming their products are "second to none" while customers are actively shopping mmm anywhere else shows a leadership team completely out of touch with reality. As someone who has worked for a toxic boss or ten, here's what I would have wanted to see from that email: acknowledge the mess, take accountability, and outline an actual path forward. As a CEO, the one thing I know you're good at is writing an email full of BS- it's a minimal requirement. Here’s a cutie picture of my last trip to Tarzhay <3 In all seriousness though, can they get it together? I miss grabbing an iced coffee and bopping around aimlessly- peak relaxation.

OneOff launching their AI-powered celebrity style search platform addresses how fashion discovery actually works in 2025 - through people, not brands. Their "Who are you wearing?" approach taps directly into what research shows: 91% of Gen Z shoppers look to creators for style inspiration. Their brilliant innovation is creating passive income for high-profile talent (THANK GOD!!!) who would never bother with traditional affiliate links (LIKE THE REST OF US PLEBEIANS!!!) by splitting 10-25% retailer commission. Starting with 100 searchable ~style icons~ like Hailey Bieber and Bella Hadid creates immediate value (that part is actually cool, ngl), while their roadmap from search to personalized recommendations could genuinely change discovery patterns. The Hermès family office (remember those guys?) investing proves this isn't just another tech experiment but a serious attempt to rebuild the path to purchase around personality rather than brand. Can you guys tell I’m losing my mind writing at this point?

Miu Miu bringing their immersive "Tales & Tellers" show to NYC during Frieze perfectly explains why they're outperforming the luxury market right now (lowkey it’s because they’re trying at all lol while everyone else regurgitates the same tired playbook in luxury). While competitors cut costs and play defense during the downturn, Miuccia Prada is expanding cultural relevance through this open-to-all installation at Terminal Warehouse. Their decade-plus commitment to commissioning films by female directors wasn't just ahead of the curve - it built the authentic foundation for their current momentum. If you’re in NYC and you’re a cool artsy fashion girl- go to this send me allllll the deets!

Want to hear your thoughts on TRR + Target- is this just current economic retail struggles or larger systematic issues? Does OneOff’s value prop excite you or does it feel unnecessary? I was so indecisive when writing this and would love some opinnies!

I’ll see you on Thursday!

LYLAS <3

xx

Carly

You should be a guest on Marketplace. They need to interview you!!

Great roundup Carly! The perfect read to kickoff the week. Hope you made it to that pilates class. You're a stronger woman than me lol.